Workshop Note: Collecting Art, The Family Office Seeding KKR, Jim Simon's 5 Principles, Buffett's Energy Bets

“Be guided by beauty. Just as a great theorem can be very beautiful, a company that’s really working very well, very efficiently, that can be beautiful.”

Hello everyone,

A few weeks ago, I bought a small woodcut print from a Brazilian artist living in Vienna. It was nothing extravagant, just an impulse buy after seeing it on Instagram and falling in love with it. Turns out that getting a custom frame was more expensive than the print.

I realized it was only the second original piece of art I own. It’d like to collect more and be guided by Jim O’Shaughnessy’s idea of focusing on living artists, which is where even small amounts of money can have a real impact.

‘Buy Art from Living Artists, the Dead Don’t Need the Money.' - Guy James Whitworth

The other piece I own is a massive piece depicting a blood-splattered Patrick Bateman. It used to be the unnerving background for zoom calls and podcasts. I’ve since rearranged the apartment and now it stares at me all day. Not going to lie, it can be pretty intense.

If you’ve watched the movie Tenet, you know that there’s another option. I could put it in storage in a freeport - a secretive and extremely secure warehouses housing art and other valuables. It’s one of the many unique and weird features I found in the art market when I took a deep dive. Despite a lack of cash flows, lack of liquidity, and insiders playing insider games, art has emerged as an asset class. It’s even being promoted to investors by private funds or platforms like Masterworks.

One compelling argument for art as an investment could be inflation protection. For example, a lot of non-contemporary art is not expected to ever trade again. It gets donated to a museum, sometimes because of estate taxes, and disappears from the market. Shrinking supply and money printing are an interesting combination. If you’re interested in learning more, I wrote a deep dive on art as an alternative asset class. And I look forward to collecting more in the future.

Table of content: recent eadings

The family office that seeded Kleiner Perkins and KKR

Jim Simons’s five principles

Buffett’s energy bets

Other:

Notes on Seth Klarman’s talk at HBS

How to succeed as a sell-side trader

Michael Mauboussin’s take on Stanley Druckenmiller

Teddy Vallee’s leading indicators

Inflation and returns in the 1970s

Corry Wang: lessons from the dotcom’s failed delivery startups

A primer on reflexivity

Piece on Jeff Yass of Susquehanna International Group

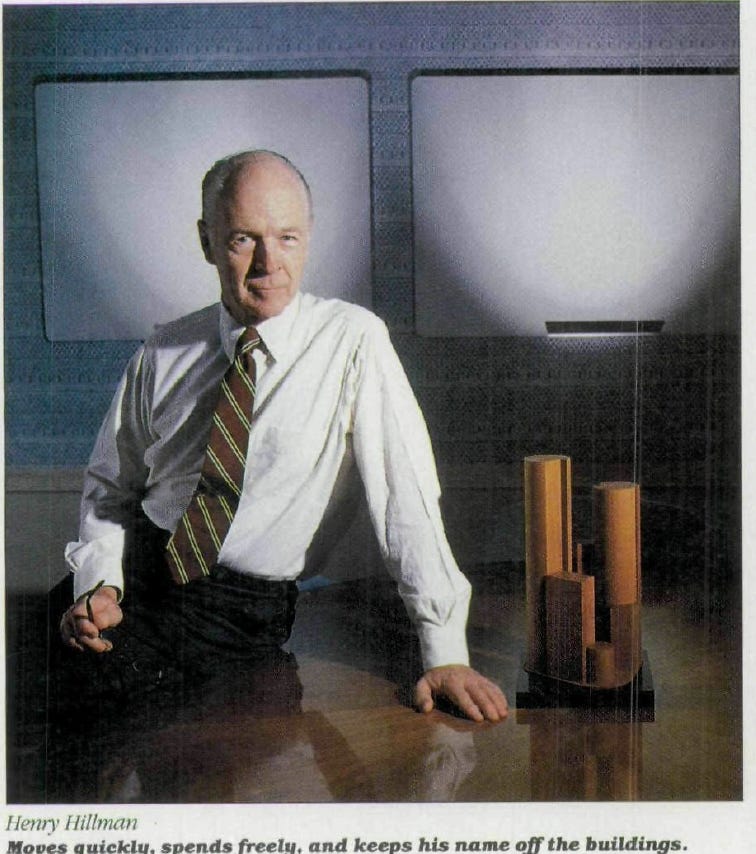

The Hillman Family Office

Keep reading with a 7-day free trial

Subscribe to Enter the Labyrinth to keep reading this post and get 7 days of free access to the full post archives.