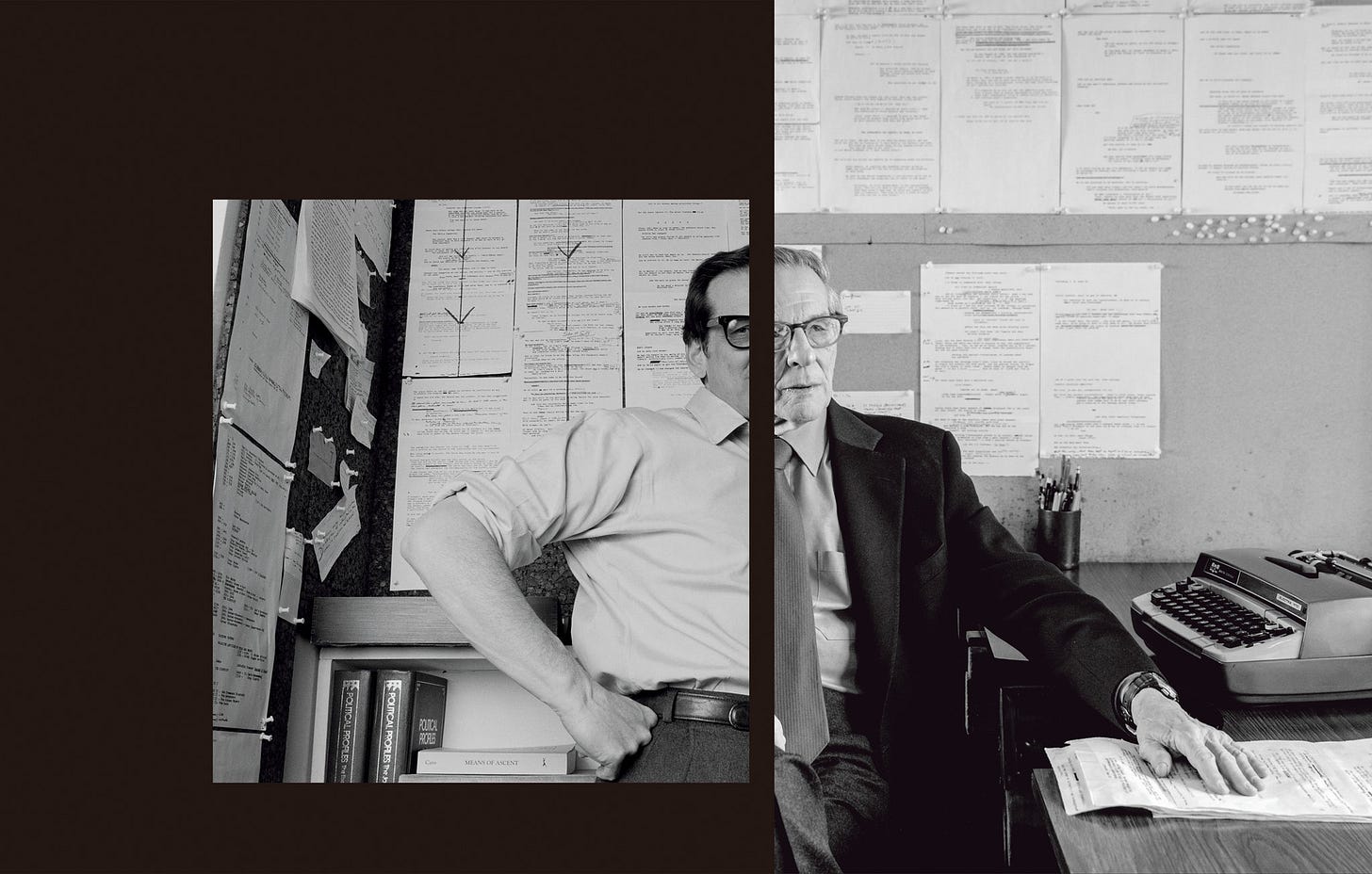

“There are certain moments in your life,” Robert Caro reflected in Working, “when you suddenly understand something about yourself.”

Caro started out as an investigative journalist. The first time he sifted through public records all night by himself, he entered a flow state. He felt “at home” while making the files “them yield up their secrets.” To him “each discovery was a thrill.”

Why did those raw files affect him so much? “In part, perhaps, because they are closer to reality, to genuineness,” he reflected. “Not filtered, cleaned up, through press releases or, years later, in books.”

Caro discovered two truths: one about the story he was investigating, the other about himself. “I will never forget that night,” he wrote.

"The most exciting phrase to hear in science, the one that heralds new discoveries, is not 'Eureka' but 'That's funny...'" — Isaac Asimov

Caro’s experience reminded me of what it was like to be an investor. Paradoxically, good investing is boring, yet discovering a great investment is exciting. It’s like the investor looks around, stops, squints, and goes “Oh, that’s weird.”

This is also what made great investors interesting to me. They spent their lives trying to find what others missed and their careers seemed like portfolios of surprising insights. I found the same curiosity in both Caro and Mr. Beast and it felt as inspiring as their passion.

I also recognized the thrill of discovery as a part of my journey to writing. Years ago, tired of working with numbers, I ventured to the library to skim old profiles and interviews. Among the dry record of economic history unfolding, I found the odd quote, a little gem of insight into markets or life.

Investors and journalists “are in the same business,” Buffett once said. “I assign myself a story,” he explained. “The story always happens to be what is X worth, but that’s a story.” Buffett investigates valuation, but for his story to be valuable, it must reveal a gap between perception and reality, between his conclusion and the market. That distance contains his variant perception, the seed of an investment thesis.

“That’s my job,” Jerry Seinfeld once told Playboy Magazine. “To understand what’s going on in life, to figure it out. The news, books, magazines and films cover a certain portion of what’s going on. But there’s a lot of stuff that’s not touched on, and that’s my job.”

Journalists, writers, comedians, founders, and scientists are all in the business of sifting the world for nuggets of truth. They look for the gap that reveals a story, an investment idea, a punchline.

“I have a friend who’s not a comedian, he’s a computer analyst,” Seinfeld quipped. “He’s always going, “See, there’s something funny about this saltshaker, but I can’t see it. You could see it.” And it frustrates him. He’s looking at the saltshaker and I’m looking at the saltshaker, and he knows there’s a joke there. He can’t find it.”

That’s the truth sifter’s job: to find the ‘funny’ hiding in the saltshaker.

If that’s you — if you can’t help but look for the “endless number of human truths” as Svetlana Alexievich put it in Secondhand Time — you are both lucky but also face a significant challenge.

Keep reading with a 7-day free trial

Subscribe to Enter the Labyrinth to keep reading this post and get 7 days of free access to the full post archives.