📚 Broken Money: Lyn Alden's Financial Inevitabilities

"This is a book about money through the lens of technological developments."

Does money follow an arc?

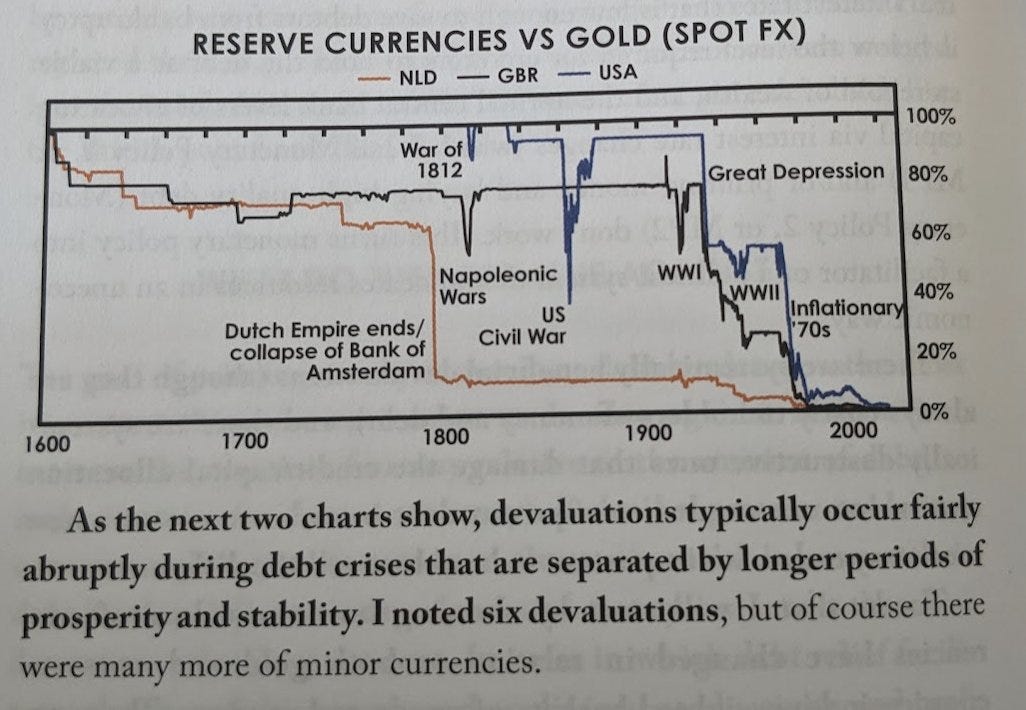

It seems that way. Early forms of money, like seashells, made way for hard commodity money. Gold and silver were eventually replaced by fiat, that is paper, money. Different currencies rise along their country’s power only to be debased in value and decline as one empire makes way for the next.

“This is not a gold book, not a banking book, not a bitcoin book, and not a political book” Lyn Alden writes in her new book Broken Money. An engineer by background, Alden treats the global financial system “as the engineered system that it really is” and explores the history and possible future of money “through the lens of technological developments.”

Alden explains the evolution of money with two key ideas: first, a filter of scarcity “with less-scarce monies gradually falling out of existence.”

Basically, whenever any commodity money encountered gold and silver in the competition for money, it was always gold and silver that won.

Second, innovation in the form of modern communications technology. Starting with the telegraph and telephone, the speed at which transactions took place accelerated dramatically. Yet the pace of settling transactions, by shipping physical gold and silver, remained painfully slow. As a result, financial transactions “had to be increasingly abstracted to keep up.” Gold remained in the vaults and transactions shifted to the banking system. In other words, gold and silver became uncompetitive.

The combination of legal tender laws, taxation authority, and greater speed has allowed fiat currencies to outcompete their slower but scarcer precious metal counterparts all over the world in terms of usage. This mismatch or gap in speed has been a foundational reason for the greater and greater levels of financialization that the world has seen over the past century and a half.

Fiat currency was “the only time in history where, on a global scale, a weaker money won out in terms of adoption over a harder money” and Alden reasons that it occurred primarily because of this shift in speed. Central banks and governments embraced the fiat money’s greater flexibility and eventually discarded gold backing altogether (or were forced to do so by the market).

👉 The rest of this newsletter is only available for premium members, whose support makes my work possible. If you’re not already a premium member, consider upgrading your subscription below.

Keep reading with a 7-day free trial

Subscribe to Enter the Labyrinth to keep reading this post and get 7 days of free access to the full post archives.